- MAIN PAGE

- – elvtr magazine – THE FINANCIAL AND MENTAL COST OF THE UNITED STATES’ HIGHER EDUCATION ISSUES

THE FINANCIAL AND MENTAL COST OF THE UNITED STATES’ HIGHER EDUCATION ISSUES

.jpg)

With the pandemic having left 10 million Americans out of work and the cost of food, gas and rent soaring, hard-working people are being forced to cut back on essentials. For 44 million graduates, a five-figure student loan debt compounds the financial strain.

Forced to act, the United States Government has paused loan repayments until June 30, 2023. Likewise, President Biden has canceled approximately 2% of student loan debt, affecting 3.7% of borrowers - more than any past administration in US history. However, with the average balance standing at $38,000 and the cost of college rising faster than inflation, the majority of Americans are still struggling to pay.

According to a new comprehensive study by ELVTR on higher education issues within the US, student loan debt continues to burden the graduate workforce, putting strain on their mental health and forcing them to delay significant life events.

Putting the American Dream on hold: The unsustainable cost of higher education

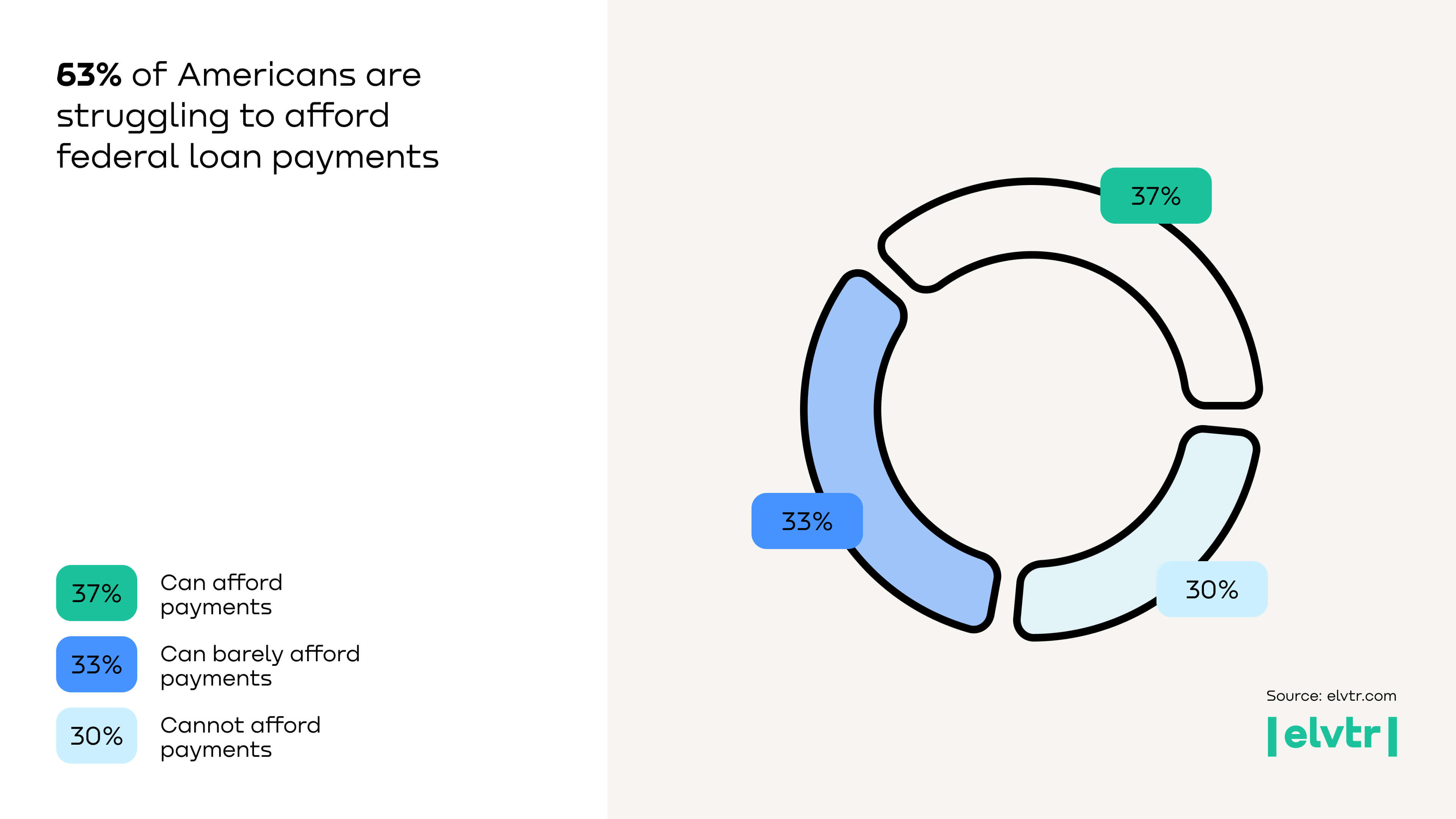

The loan forgiveness initiative reduces the burden, but for two-thirds, it simply isn’t enough. With a third just barely able to pay, many more will struggle to cover the cost of their student loan debt as the crisis worsens.

The situation is exacerbated for some women, Black or African American graduates, who are more likely to face financial hardship as a result of their federal loans during the current crisis. Data shows that 69% of women are struggling to pay, while 79% of Black and African Americans are unable or barely able to afford payments, putting them at greater risk of defaulting.

Just one in five Americans are fortunate enough to have been unaffected by the financial climate, with the vast majority having put an important life event on hold to keep up with student loan repayments. A third have delayed starting a family, more than half have shelved their plans to save or travel, and over 60% have put a major purchase on hold.

America’s graduate mental health crisis: The mental strain of student loan repayments

It isn’t just America’s pockets that are suffering. With many facing financial hardship like never before, the pressure of student loan repayments also impacts the nation’s mental wellbeing. ELVTR’s higher education study found that most (54%) have experienced mental health issues brought on by their student debt.

At 56%, anxiety is the leading mental health issue caused by student loan debts, while approximately one in five have endured sleepless nights and panic attacks as a result. Likewise, with many facing a tough choice between making payments and fulfilling their basic needs amid the cost of living crisis, 32% have experienced depression brought on by their debt.

Financially unstable, behind their peers and unskilled for the future: America’s modern graduate

Seeking rewarding careers, greater opportunities and increased earning potential, most borrow money to fund their studies, whether from government, private lenders or family and friends. This is a decision most now regret with just 41% believing it to be a good investment. A similar amount (36%) do not think borrowing to further their education was worthwhile, while 23% have lingering doubts.

Earnings that fall short of expectations could be to blame. Despite costing tens of thousands of dollars, taking on student loan debt doesn’t guarantee graduates a well-paid role. In fact, ELVTR found that 60% of educated Americans earn less than some of their friends who have not acquired higher education.

As well as the financial issues, concerns over long-term opportunities likely contribute to this regret, with many on the fence about their future prospects. While 70% believe their education is still in demand, almost half doubt this will still be the case in a decade.

With this sense of regret often comes a longing to change the past. In fact, ELVTR research shows just 23% of Americans are happy with the college choices they made. With the opportunity to do things over, almost a third would choose a different field, while 32% would opt to attend a cheaper school or avoid higher education altogether, suggesting serious problems with the education system. Given the financial climate, just 4% would increase the amount they invested in their education.

Unsurprisingly, given these concerns over cost and longevity, Americans are divided on whether they choose the right profession. Some 36% say they regret their choice, while 18% remain uncertain.

The graduate gold rush: Seeking better prospects within in-demand industries

Luckily, many are making the best of a bad situation and taking the opportunity to embark on a new career path, with half of those surveyed having already pivoted into a new field. More will undoubtedly follow. With inflation having peaked, many are seeking new opportunities in search of better pay and security. In fact, only 27% plan to stay in their current industry, while 40% actively plan a change. An additional third remain hesitant, but as living costs rise, those on the fence are likely to be swayed.

With software and IT jobs among the most in-demand and highest paid, this industry predictably ranks as the most highly desired among those that hold regrets over their education choices. In fact, nearly half of all graduates would choose a role in the IT or creative industries over their degree if given a chance to change.

Methodology

To create this higher education report, researchers at ELVTR surveyed 2,000 Americans aged 18 to 67 that have enrolled in college and received some form of higher education. All genders and races were included in this study.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)