- MAIN PAGE

- – elvtr magazine – THE COST OF EDUCATION

THE COST OF EDUCATION

"Perhaps you should, like water, take the route of least resistance, or the path of highest value, calculating ROI, adjusting for inflation and contemplating LMS Metrics, whether that be through the door’s of an ivy league school or a virtual classroom. No matter which direction you go, there’s risks."

AARON FELDSTEEN /

WRITER @ELVTR

Finding your way through the myriad of educational druthers is a quagmire indeed. In your thoughts, there’s no surefire path to success.

When you think about it, your mind churns with the desire to pursue the career of your choice, the cost of it all, and the fear of failure. You become irrational, you want to fold your hand all-together, wish to consult the Oracle of Delphi (as in the History of Herodotus: Western literature's first Annalist), or Tarot Cards. However, conceding to fallacious reasoning and biting your nails is of no use.

Instead, like a sleuth, you may want to investigate and weigh clues as they come to you. Being unbiased as possible, as you consider the trajectory of your life with a certificate or diploma in your pocket,

Following the paper trail that will someday be your future, perhaps you should consider education an investment and your lifetime income a return on the capital. Alternatively, you might use a qualitative means of examining the leads.

Putting the quantitative method aside, you may ask yourself, 'would I prefer working with my brains or brawn? Do I have the fortitude to endure a 4-year education? Would e-learning be the best for me?'

While tracing future outcomes, keep this in mind: online education and a degree aren't necessarily opposing pursuits. There are online courses such as:

- MOOCs (Massive Online Open Courses) that don't offer a degree, but they provide a certificate upon completion, such as Teaching English as a Second Language (TESL)

- Online education institutes like the University of DeVry that offer Bachelor's degrees

- And non-virtual education, a path that may offer a degree, certification, or personal enlightenment

Quantifying Lifetime Income: Continuing Education

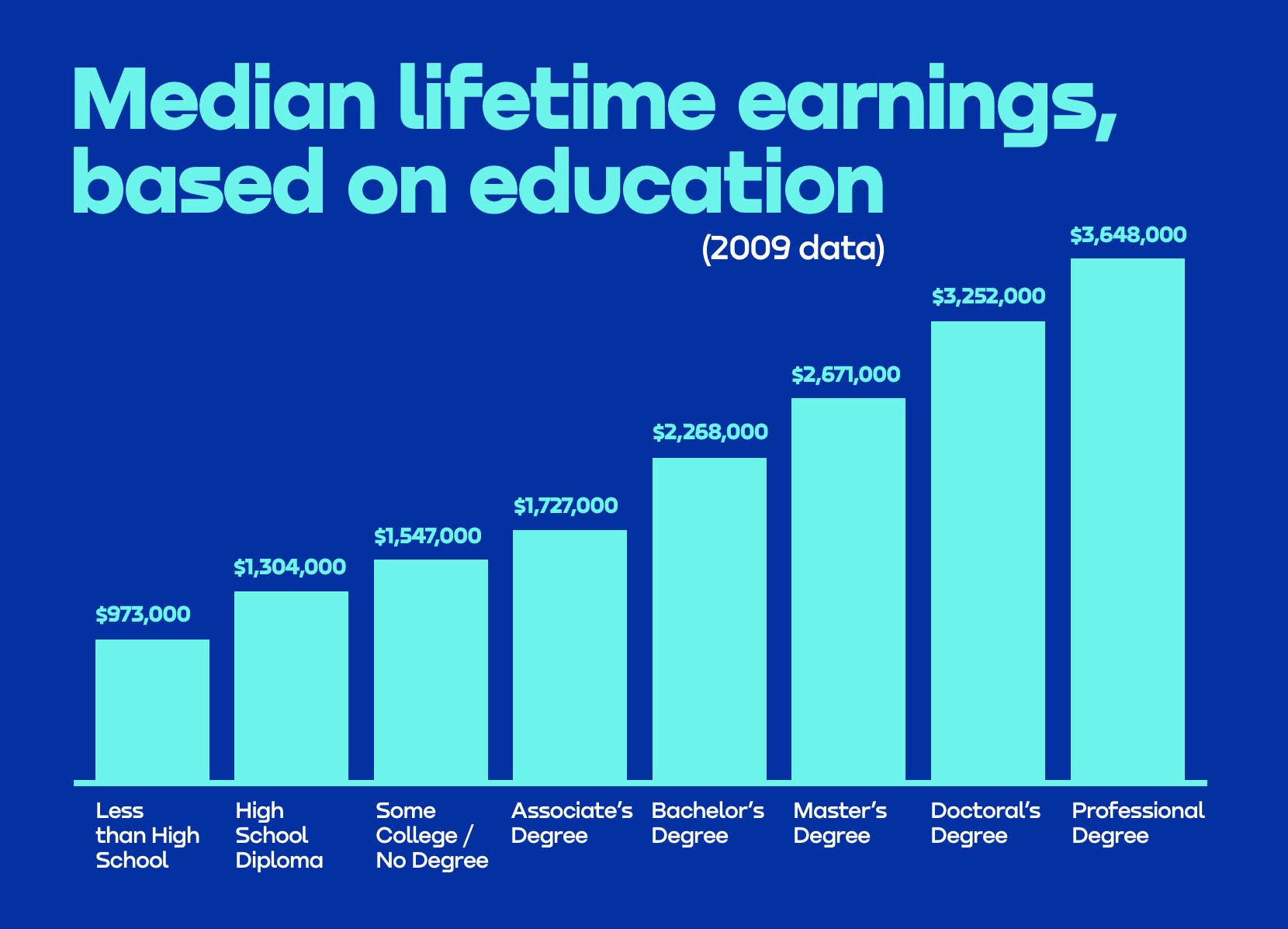

Back in 2009, Georgetown University concluded that those who have “some college” under their belt, make $1,547,000 in their lifetime.

I can only assume that having completed continuing education classes fall under this umbrella. But, neither the phrase “continuing education, e-learning" nor “distance learning” occur in the study, despite the genesis of non-diploma online courses coming about as far back as 1994.

Notably in 1994, CALCampus (Computer Assisted Learning Center) offered the first online non-diploma classes. Yet, an old stigma remains: "without a degree, nobody cares what you have to say" (or includes you in their dataset).

Because of this odium, in the eyes of Data Analysts, education equals accredited colleges, not non-diploma distance learning classes. Thus, those with continuing education credits are inaccurately represented in statistical data.

Returning to the study, if we put credence in Georgetown’s findings and assume that Americans, on average, work for 47 years before retiring (65-18), those who didn’t complete college make about $33,000 a year (1,547,000 /47). This includes trades and entry-level IT jobs like Java Programmer.

Demonstrating our margin of error, Glassdoor places an entry-level Java Programmer’s annual salary around $44,000 – our assumption is sound enough - plus or minus $10,000 isn't the thinnest margin or error, but it's a good starting point for deducing that value of "some education."

Playing with the numbers on Glassdoor, entry-level desk jobs that require no investment range from $33,000 - $35,0000: Phone Operator, Secretary, Data Entry... The list of these underpaid, overworked positions goes on and on.

To confuse things even more, careers like Masonry Worker and Firefighter need no secondary education and can pull in around $50,000 a year.

And then, there are jobs that require a bachelor's that make around $37,000 or less — college-level Teaching Assistants make about $34,000, for example.

Metrics: Education's New Parameter

Having this said, you may ask: "Are there better methods for calculating educational efficacy, something other than sifting through Georgetown’s scholarly articles?"

Indeed, there are a few ways to evaluate how effective courses are. These methods range from qualitative to quantitative.

Metrics, something that blends the qualitative and quantitative, have become part-and-parcel of every industry, even education. And although they are here to stay, I place little stock in Learning Management System Metrics (LMS Metrics) for students — something that compares time spent on questions, teacher interaction, student feedback, etc. To me, any time spent learning is time well invested.

But, LMS Metrics do have a place. These measurements are often used by businesses to decide whether or not classes are worth enrolling employees in.

And as a whole, Learning Management Systems are useful. Their market share is the best indicator of this. “The global Learning Management System (LMS) market is expected to reach $38 billion by 2027, with annual growth of 19.1%.” For students, LMS Metrics mean more surveys to fill in and more data about the school experience, both online and offline.

Taking all things into account, it may be wise to consider LMS Metrics alongside other factors. It's said that, “satisfaction ratings [assist] you [in] determining Return On Investment by [obtaining] corporate learners' perspectives."

Negative opinions indicate that a course may need fine-tuning in order to improve return on investment, or that class just doesn’t gel with real-world needs. In a vague way, these metrics can be used to determine the worth of a class.

Stacking the Cards: Calculating ROI

But in my opinion, measuring potential lifetime income is the most effective way to decipher if a class is worthy of your time and money.

Return on investment (ROI) gauges the “profitability” of an investment. To calculate ROI, the benefit is divided by the cost of that investment and multiplied by 100%. The result is expressed as a percentage or ratio.

There are limitations to ROI. Firstly, ROI doesn’t disclose annual revenue. However, to figure annual income, simply divide your median lifetime earning by years worked.

Secondly, ROI doesn't account for inflation. This means that you may break even or lose money on something that appears to yield profit. For example, you bought a bond, the bond was reported to yield 2%, however, inflation, during the years you held the bond was 2.5%. You effectively lost 0.5%.

Yet, Inflation Adjusted Return (IAR) accounts for the dollar's dwindling buying power, and, considering inflation rates continue at their current momentum, IAR can foretell future buying power.

Moreover, there are more accurate tools for finding the return of an investment, Return on Capital Employed (ROCE) examines net profits before and after liability (bills and taxes), but to calculate this over a lifetime would be Big Data, big data based on a sea of presumptions. Over such a span, with so many wildcards, ROCE loses all accuracy.

Another limitation to ROI is that we are using averages, presuming that your life’s trajectory is similar to everyone else with the same education. All things considered, even attempting to account for race and gender, there's no accurate way to come within the proximity of gross lifetime income.

Return on Interest, albeit an "OK tool" for predicting asset generation, it's flawed.

Despite limitations, ROI is effective enough, “Social Media ROI pinpoints the potency of online campaigns (the number of clicks or likes are generated for a unit of effort). “Marketing ROI identifies the return attributable to advertising or marketing campaigns.” And, “Learning ROI relates to the amount of information retained [in a classroom],” according to Investopedia.

ROI in Action: Some Less Than Perfect Anecdotes

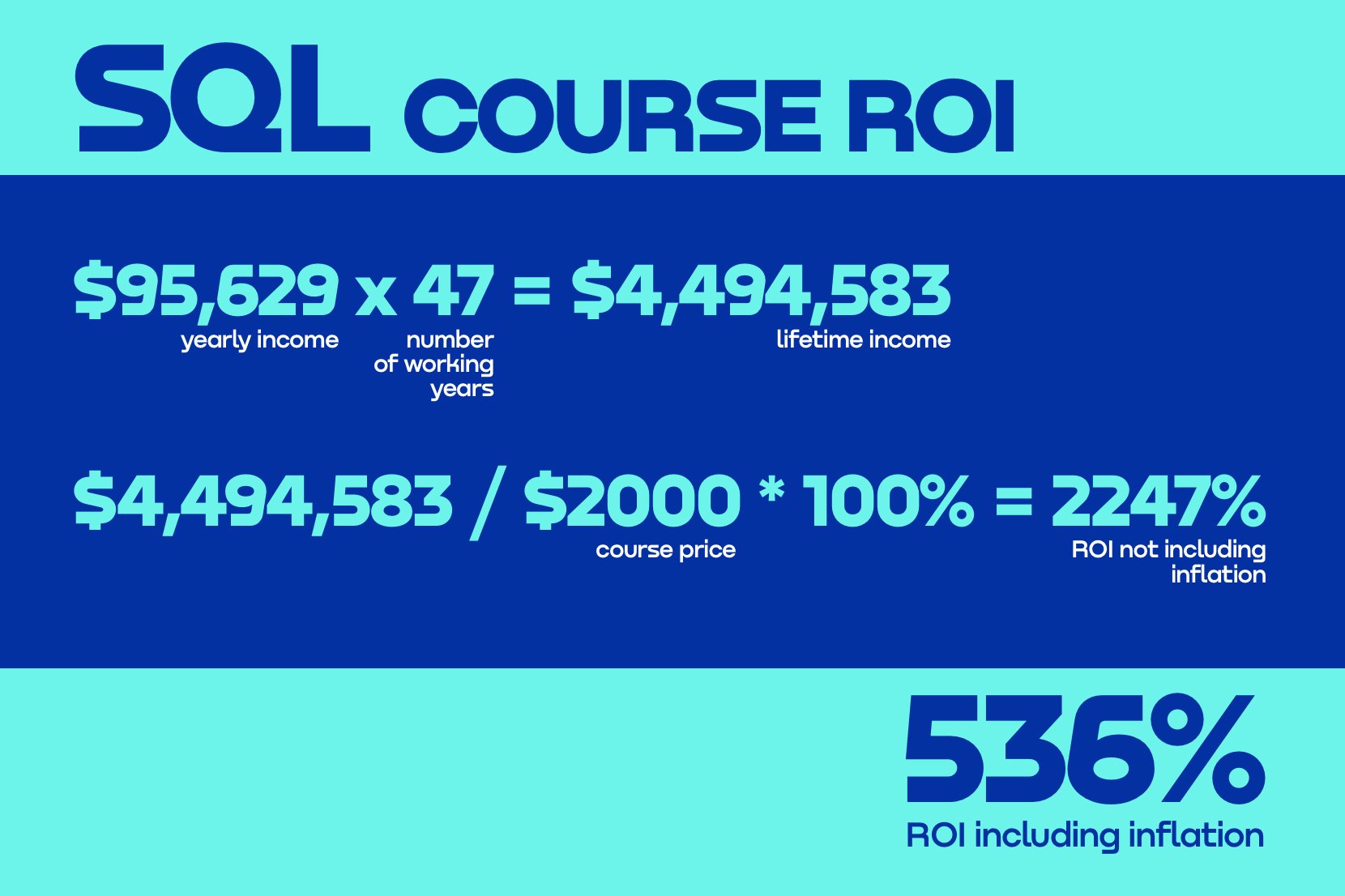

On average, an online IT course, say SQL, will set you back Two Grand. On paper, this seems like a great deal of money, but we must look at potential income. For example, the mean income for a SQL Admin is $95,629 per year. A career that's great for data-heads and will most likely be around tomorrow, according to our resident SQL Teacher, Adam Gorski.

Transforming our SQL Admin position into an ROI calculation, if we punch in the numbers:

(95,629×47) = 4,494,583

/ 2000×100%

Our return is 2247%, not shabby.

However, adjusting for inflation decreases the spending power of the 4 million dollars you made during your lifetime. Assuming that the inflation rate remains at 3%, and working with this calculation

1 - 0.03 = n

n ^ 47xY

where n (0.97) is the product of 1-0.03 (our yearly inflation rate), coming to 0.737424126, this is raised to the power of 47 (the average career span of an American), and Y is the unadjusted income, ($4,494,583).

Suddenly, your lifetime revenue falls to $1,073,892. A difference of $3,420,690. Applying ROI on our adjusted income:

1.073,892/ 2000 = 536%

We are left with a 536% return on our investment, 1,711% less than calculating return with ROI alone. And, this doesn't account for income tax. Clearly, we've reached the limitations on performing ROI calculations with limited data.

Besides, the above calculation doesn't take promotions into account. It's assumed that you make the same throughout your lifetime. So, if you take the experience and evolve with Data Science, your earning potential is only limited by the industry income cap. This is true for any field, not just Data Science.

The Ivory Tower: A Tower of Cost and Prestige

In the above scenario, our imperfect calculation, your lifetime net income as a SQL Admin came to $4,494,563, almost double today's national average ($2.7 million).

This is $1,153,000 more than those entering the job market with "some education" were projected to make in 2009 ($1,547,000), demonstrating that those with "some education" can do well for themselves.

Despite these calculations, a myriad of “ifs” come into play. Lack of a college degree may leave you as jetsam on the bottom of job boards., two thousand bucks poorer. With this in mind, it may be worth the while to buckle down and get an “ivory tower” education. After doing so, in your mind, the odds of getting that dream job are stacked in your favor.

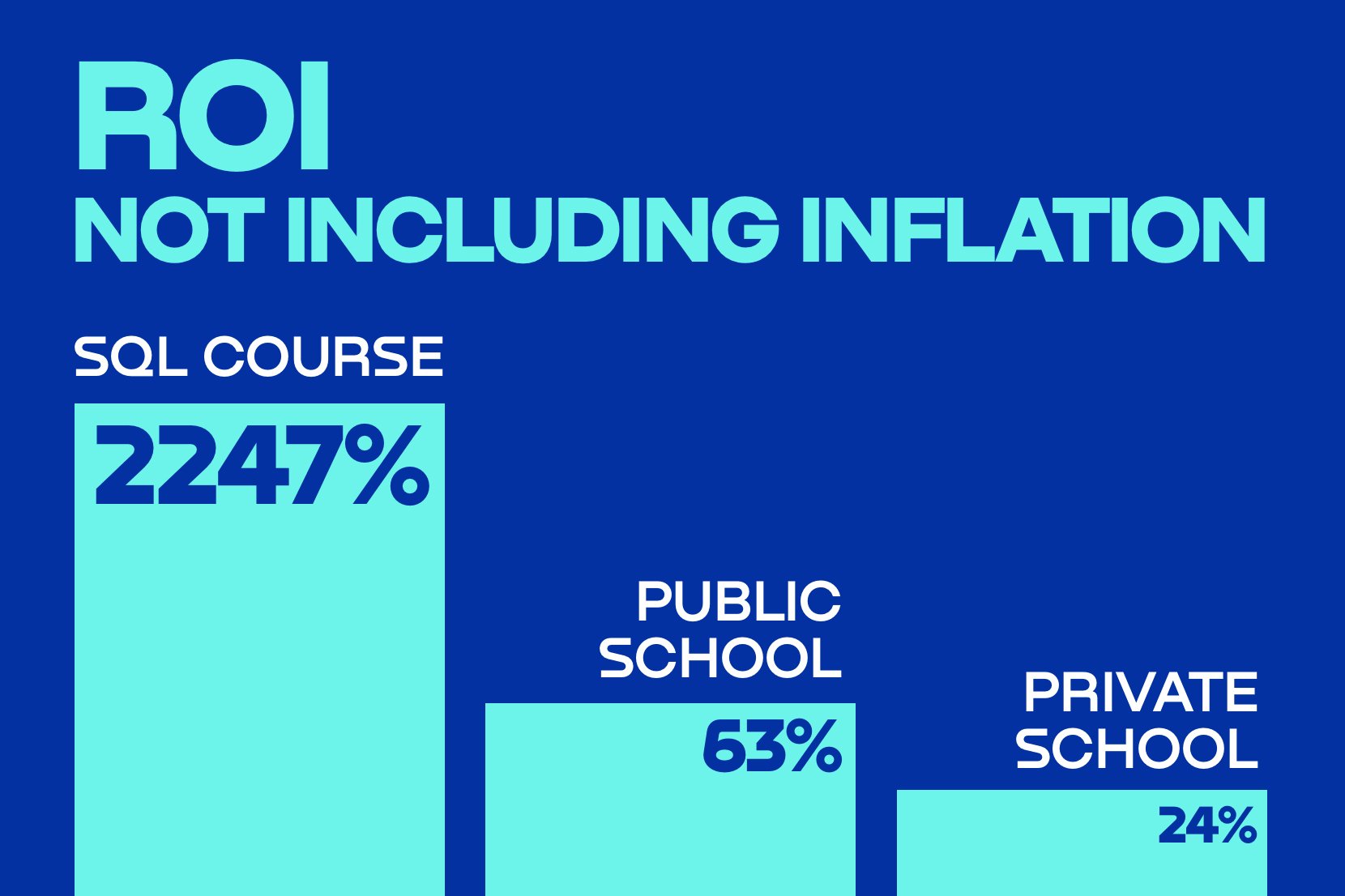

But here's some food for thought, including tuition, fees, room, and board, the annual cost of attending public school is $17,797, on average. Over 4 years, this adds up to $71,188. And applying our ROI calculation, assuming you used the degree to bag the SQL Admin position (the degree gave you an advantage that got you in the door) the ratio drops to 63%. This return is 35 times less than attending a continuing education course alone.

If you were to attend a private non-profit school, your total bill would come to $184,056, before holding that diploma in your hand.

And, if you were to get our hypothetical SQL Admin position, the ratio falls to 24%. Still in the positive, but not the windfall that a 2000% return yields. Attending a private for-profit school, an Ivy League education lowers the return ever more so.

Moreover, when it comes to the sexes and traditional education, there isn't income equality. Men with a bachelor's rake in “$900,000 more in median lifetime earnings than high school graduates,” and women with the same degree make “$630,000 more." That’s a disparity of almost $300,000. The effects of race and gender on obtaining a job is something to consider before entering the Ivory Tower.

If after weighing all the factors, the dread-inducing length of a 4-year education, knowledge of the follies of traditional education and of those who "made it" without stepping foot in an ivory tower school, alongside the cost, may be ushering you towards non-diploma online classes such as MOOCs.

The New School: Cyber School

Perhaps, the time is nigh for you to look into non-traditional forms of education. Plague or not, fees for on-campus parking, housing, and meals can be astronomical!

With this in mind, you may feel that e-learning is the way to go. In fact, numerous students are simply taking a handful of remote classes and hitting the job market, in lieu of a full-blown education.

In the minds of many students, online classes provide real-world applicable experiences, whereas universities equip learners with the theoretical, Besides, during a Pandemic, social distancing is the responsible thing to do.

It’s worth mentioning that, universities and other places of learning have had to swiftly adapt to change before the Covid Pandemic. For many of these institutions, retreating to the safety of virtual classrooms is the natural thing to do.

For example, during 14th Century, “Oxford University reacted [to the Bubonic Plague] by sending the majority of their students and staff away [on leave]," laying down the roadwork both e-learning, although it wasn't known by Oxford's staff and a map for dealing with future outbreaks of contagious disease.

Admittedly, sending students and teachers on an extended holiday is much less complicated than curating virtual classrooms, but educational institutes are known for being on the cutting-edge. It’s there that electronic music was created, vacuum-tube computers first computed factors and the webcam came about.

Again, educators have had to adapt to the times. During the Spanish Flu of 1918, schools in Los Angeles “implemented a mail-in educational correspondence course, [instead] of in-person instruction. This learning format [is possibly the] precursor to today’s e-learning platforms.” I say this to legitimize e-learning, it's roots date back 200 years and it's nothing to scoff at.

As an indirect result of the actions of LA schools, 1994 became the genesis of e-learning, CALCampus adapted mail-in learning to the World Wide Web and created what is now considered the first completely remote non-diploma courses. As a side note, as far back as 1989. Phoenix University offered online degrees. All-in-all, Education is dependably the forerunner in forward-thinking. And so, offering online classes is simply the next manifestation of education’s trendsetting reputation. However, the questions that remain are:

Should I take accredited courses?

Will employers place any salt in my online classes?

I was always told “online education is worthless” and, in regards to hiring practices, many employers continue to feel this way. To add insult to injury, there are those institutions that even refuse to host online courses.

But, there’s a reason for this, “online education has not lived up to its potential,” according to Spiros Protopsaltis and Sandy Baum, George Mason University, “online course work contributes to socio-economic and racial achievement gaps while failing to be more affordable than traditional courses,” concludes their study.

Socio-economics aside, with online education, schools save. And, sometimes they “pass the savings onto you,” to borrow from a commercial. In fact, “educational institutions [save] from 12 - $66 per credit hour. That [makes] a difference of 3 - 50% [on] the average credit hour’s costs.”

To demonstrate, 59% of US market shares are dedicated to e-learning. This format garnishes so much corporate attention and financial backing because it’s both profitable for institutes and in many ways desirable for students. E-learning is becoming like Pop Music, a tried and true formula for corporate success.

Apart from the socio-economic factors that plague all educational institutes, there’s little reason for universities to not offer online course loads for both accredited and continuing education career paths.

Well, there is one reason, some trades can’t be learned online. I wouldn’t want my Dentist to have been trained via virtual reality. Imagine the bedside humor! But it’s not just Dentist that shouldn’t receive VR instruction – Auto Mechanics, Plumbers and Electricians need hands-on training.

Because of online learning, many would-be Lawyers, for example, are struggling to pass the Bar Exam. One student even called the situation "literal hell."

The story:

Kyle, a Brooklyn resident, planned to take Bar Exam in Florida. After being informed that out-of-state test-takers would need to quarantine, he booked an Airbnb for $1,500. Then, the Florida Board of Bar Examiners released an announcement, the exams would be canceled and replaced with an online test.

Kyle reports that "only a $300 cleaning fee from the Airbnb was refundable and the bar process includes several fees, which vary from state to state, and that can be prohibitively expensive for some."

Although this is somewhat anecdotal, their situations are in no way unique Dishearteningly, their story is wrought with miscommunication and others taking advantage of the COVID Pandemic.

On top of that, a rudimentary Google search reveals many cautionary tales on the subject of online learning during the Pandemic, to these victims of Pandemic induced blunders, online education has hindered learning and application of it in the real world.

Despite limitations and the qualms of students whose career paths require a real-world application, it’s said that, “augmented and Virtual Reality technologies will be one of the biggest innovators of the [education] industry,” in the coming decades. Mich like Pilots and flight simulators, doctors-in-training will practice operations in virtual reality and Lawyers will debate with AI.

As whenever VR and AI are mentioned in regards to practical applications, there are hurdles to overcome. Even today's chat-bots are sub-par.

Yet, there’s another downside to online education, aside from the constraints of learning in a virtual environment. fraternal organizations don't have the same impact in the digital domain. Rare is the case that lifelong friendships are forged in cyberspace.

This sentiment is echoed by Dani Weatherford, CEO of the National Panhellenic Conference: "building interpersonal relationships is such a crucial part of the undergraduate experience and those opportunities [have] been taken away from [students]." Though Weatherford adds that students are "building relationships in the virtual environment," they certainly don't have the lasting power of those forged in person.

All this aside, if you fall into the “right” socio-economic class, online education may be the way to go. In most cases, it’s not free, but less costly, saving money for both institution and student. Online education may not yet bridge the racial gap and virtual learning environments may not be perfect, but they are ever-evolving.

In fact, "for 86% of online degree graduates, the value gained from their online degree exceeds or equals the cost they paid for it." But, we must be careful not to conflate an "online degree" with a certification. There remains little information about median lifetime income and MOOC-like classes.

E-learning in the Office: Efficiency at its Finest

Nowadays, employers are placing their limited employer learning time in the cloud. According to The National Centre for Vocational Education Research (NCVER), an Australian non-profit, “ cost, ability to tailor training and flexibility [...] are the key reasons for employers choosing unaccredited [courses] over accredited training.”

How limited is employee learning time? “On average, employees only have 24 minutes per week to spend on learning,” and so, the time needs to be well spent.

In this arena, LMS Metrics matters, time with an instructor means little when you’re on the clock and have other tasks to complete. As a result, these measurements have been deployed to create speed learning courses.

“IBM managers,” for example, “we're able to learn five times more content at one-third of the cost [in a virtual classroom]. In the end, IBM saved $200 million, which accounted for around 30% of their previous training budget.”

“Shell, one of the largest oil companies in the world, has used e-learning to reduce the cost of their priciest training programs by 90%, [they have] delivered more than 12,000 virtual lessons and saved over $200 million.”

All things considered, “e-learning takes 40 – 60% less [of an] employee’s time than traditional learning.” And, online education develops skills that are highly job-relevant or organization-specific. It's in this realm that e-learning shines through. If your employer asks you to take an SQL course, for example, you are guaranteed promotion.

BA or AA: Case Study

Not all careers that require a degree shell out the peanuts. And to add fuel to the grievances of the low-income fire, “a third of companies with current high-school graduate employees limit job applicants at these same career levels to college graduates.“ This is bad news for job seekers, indeed.

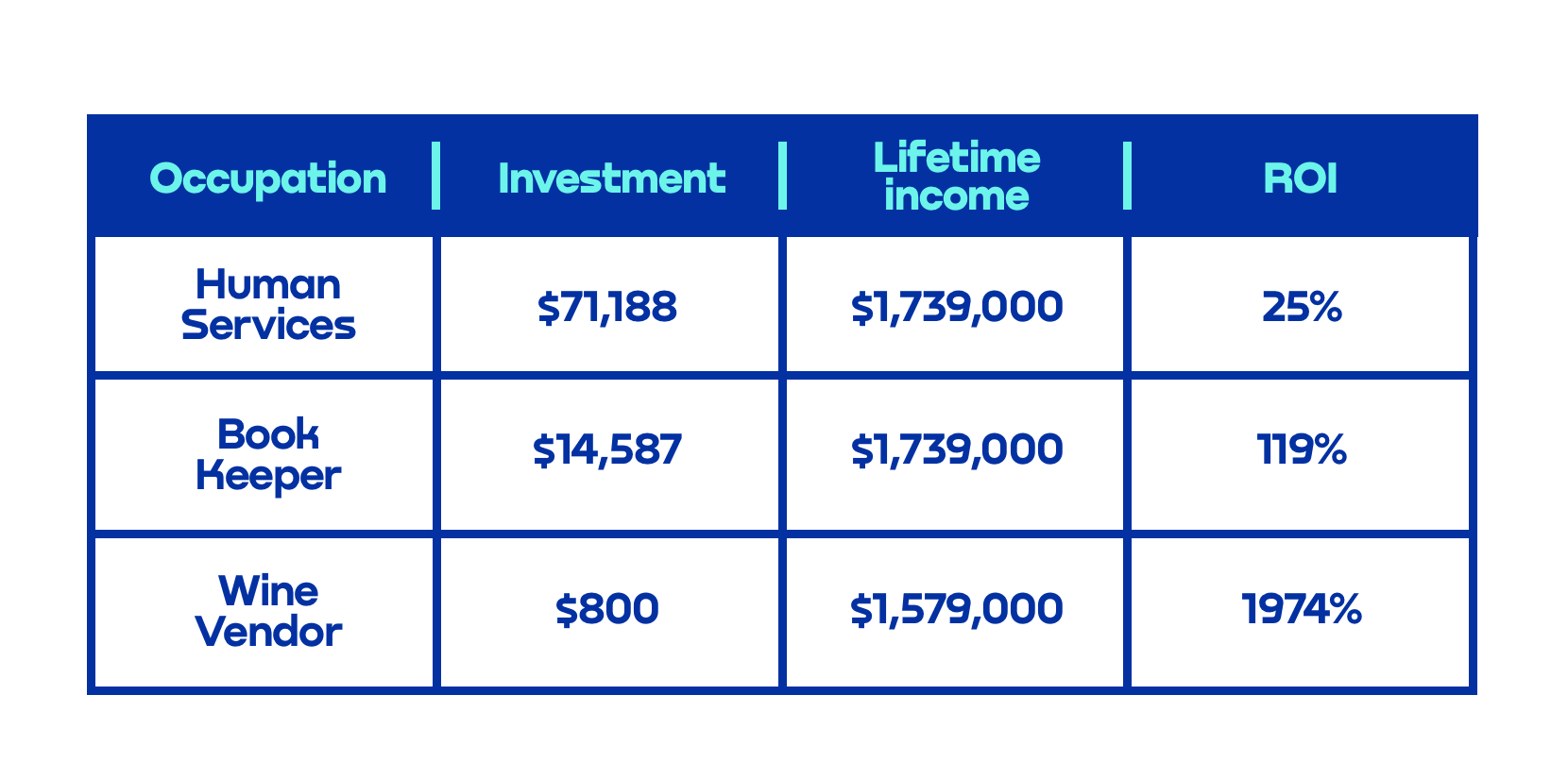

However, it’s good news for comparing ROI on educational investment. Due to the high demand for degrees or continuing education in the job market, we can compare two roles with arguably similar skillsets. For example, a bachelor's degree is required to work in Human Services — a laudable career, without a doubt. And, an associate’s degree is required to work as a Book Keeper, those busy-bees that keep business honest.

Human Service Counselors work with the human element, managing individuals and their needs to become self-sustaining. Human Services Counselors must, among other attributes, understand human development, be concerned with both treatment and rehabilitation, care about interventions and have a desire to assist in skill planning.

Whereas a Book Keeper works with the financial element, managing the books and the flow of cash. They must, among other duties, record transactions, process payments, conduct daily banking activities, produce various financial reports and reconcile reports to third-party records.

Both careers require passion and attention to the coming and going of their respective assets, whether they are people or money. And, both can pull in as low as $37,000 a year. Most importantly, both make a median lifetime income of $1,739,000. $961,000 less than the national average.

For women (considering that they make $430,480 less than men in their lifetime) the lifetime income would be $1,308,520.

For the Human Services Associate, if they attended a public school and paid the national average to get a bachelor’s degree, $71,188, their ROI would be 25%.

For the Book Keeper, assuming they paid the national average for the associate's degree, $14,587, their ROI would be 119%. That’s a 94% disparity, with the Book Keeper coming out on top.

Calculating the annual return for the Human Services Counselor with this equation:

(1+X) ^ 47 – 1 = Y

Where everything before the equals signs is the time horizon, yearly return on investment is about 5%. And using the same computation for the Book Keeper, yearly return on investment is about 17%.

Again, assuming that income is static and adjusting for inflation, for both careers, lifetime spending power is reduced to $415,500. However, a more robust calculation would include lifetime annual raises. On average, Americans receive a 2.9% wage increase a year. Factoring this in, both earn $3,614,335.

Let's put it together, both the Counselor and Book Keeper make, not adjusting for raises or inflation, $1,308,520 during their lifetimes. However, considering raises, they will take in about $2,614,355. If we adjust this for inflation, assuming that inflation will remain steady at 3%, their lifetime spending power is reduced to $624,649. There's a deviation of 318% between actual income and purchasing ability.

Combining the data suggests that the Counselor and Book Keeper may hit an income cap for their field and need to renew skills towards that latter half of their career, perhaps through e-learning.

Now for the jobs that require no degree, Indeed currently advertises a Customer Happiness Agent for the wine industry. The position is fairly paid and, phone operators speak to winos all day, to boot. Certainly, drunks attempting to use the internet make for interesting conversations. Moreover, the job isn’t physically demanding:

As for your responsibilities, if you accepted this position, you would listen to customers, give customer service, answer questions and find lifetime fixes to problems, according to the ad

And, this Napa Valley wine distributor provides a comprehensive compensation package. It includes healthcare, gym contribution, continuing education reimbursement...

If you worked for this wine vendor, you would take in $33,000 a year, that’s $1,579,200, during your lifetime, only somewhat less than the Human Services Counselor and the same as our Java Developer.

And, looking at the ROI, assuming you bought your phone for $800 and developed your charisma for free, your return would be 1,974%, almost as high as taking an online class and getting the SQL job.

In the End

Admittedly, there are some challenges in coming to an unbiased conclusion, when it comes to deducing median lifetime income for those who have a high school diploma and enroll in continuing education courses; there’s little statistical data on the subject

All things considered, perhaps you should, like water, take the route of least resistance, or the path of the highest return on investment, calculating ROI, adjusting for inflation, and contemplating LMS Metrics, whether that be through the doors of an ivy league school or a virtual classroom. No matter which direction you go, there are risks.

Somewhere, where the diagram's circles intersect, that cross-section where "a livable income" and passion meet, that's the career for you. In the end, it's your life, if life compels you towards a non-diploma education, you must muster up the determination to follow that path. Or, if you decide on traditional education, you must possess the fortitude to stick it out for 4 years.

Regardless of what happens, remember, “a failure is an event, not a person,” as Motivational Speaker Zig Ziglar was known to say, and we aren’t here to appose this criterion. If you fall flat on your face, try again. The best of thinkers met with flack, but they persevered.

*ELVTR is disrupting education by putting proven industry leaders in a virtual classroom with eager rising stars. ELVTR courses offer 100% instructor driven content designed to give you practical knowledge within a convenient time frame. Choose the right course for you!