- MAIN PAGE

- – elvtr magazine – AMERICAN DEBT: HOW THE HIGHER EDUCATION SYSTEM IS SHORT-CHANGING AMERICAN STUDENTS

AMERICAN DEBT: HOW THE HIGHER EDUCATION SYSTEM IS SHORT-CHANGING AMERICAN STUDENTS

Higher education is thought by many to be the key to unlocking the American dream. You go to college, work hard, secure an internship, and then, voilà – your personal driver is taking you back and forth from your corner office with a treadmill by the window. If only it were true.

The reality is that even the most prestigious universities offer no guarantee. Most students spend years pursuing a degree only to receive a huge bill and plenty of regrets. It’s like the very worst hangover.

But with one in seven Americans having taken on student loan debt, the reward must be worth the struggle, right? Wrong. Student debt puts pressure on graduates, often right up until retirement age, at a drastic cost to their mental well-being – and ELVTR research shows that the return on this investment is nothing to write home about.

Priced out: The rising cost of attaining a college education

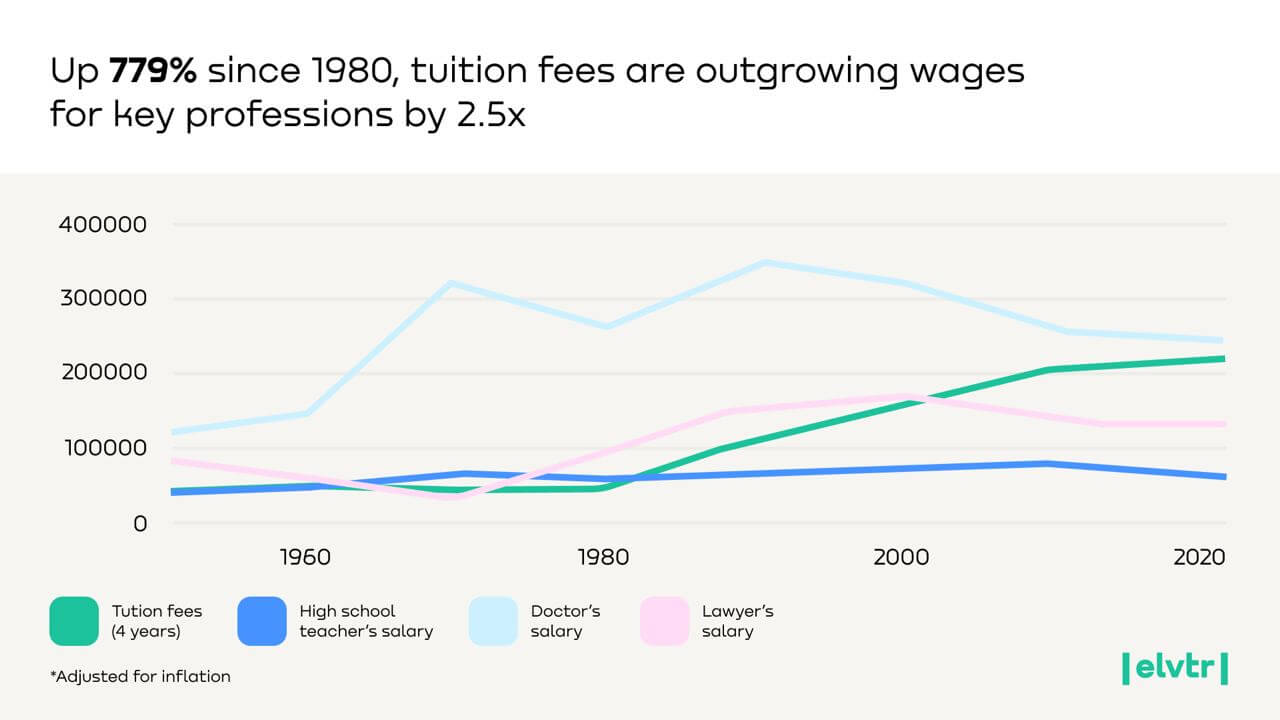

With each passing decade, skyrocketing tuition fees are pricing more and more Americans out of higher education.

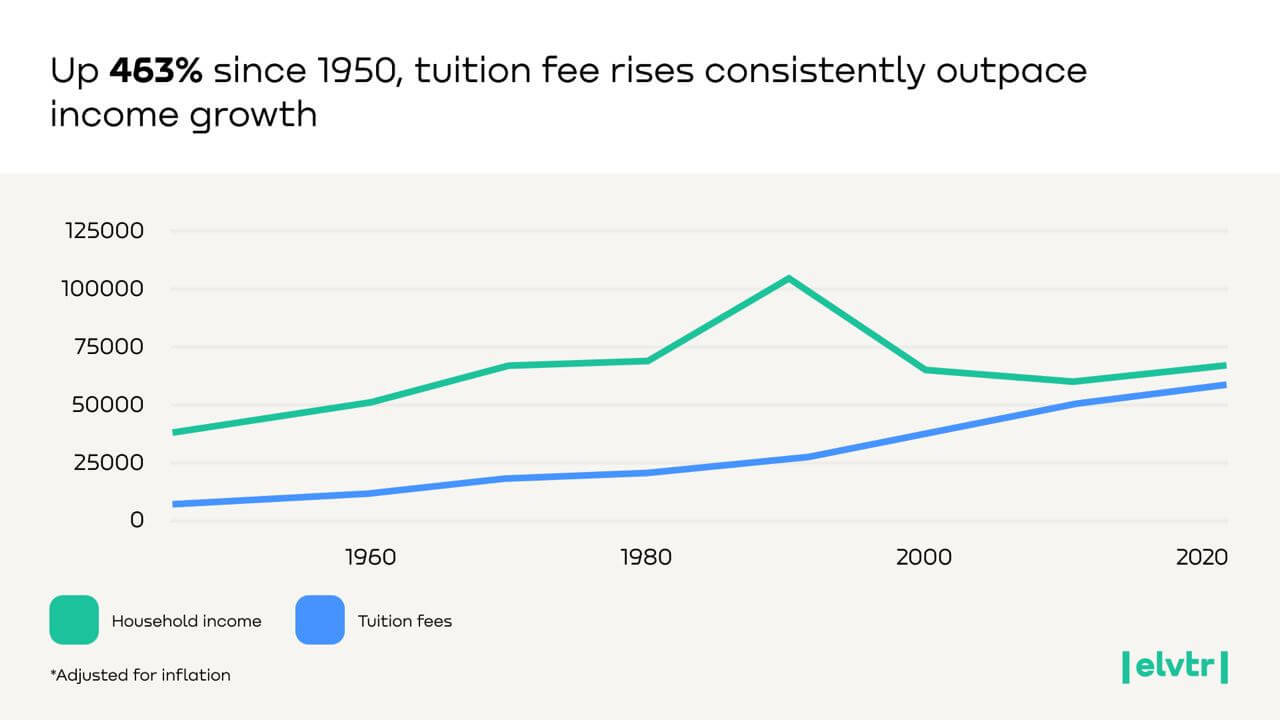

Back in 1950, attending a top-six institution cost just $899. That’s equal to $8,968 today. Yet, anybody who has studied in recent years will know that is far from reality. With prices having risen 4.5 times when adjusted for inflation, that same degree will cost you a whopping $55,590 today.

Unsurprisingly, the average US household income isn’t keeping up. In fact, with inflation considered, wages haven’t even doubled in the same period. And yet, the cost of education just keeps on rising.

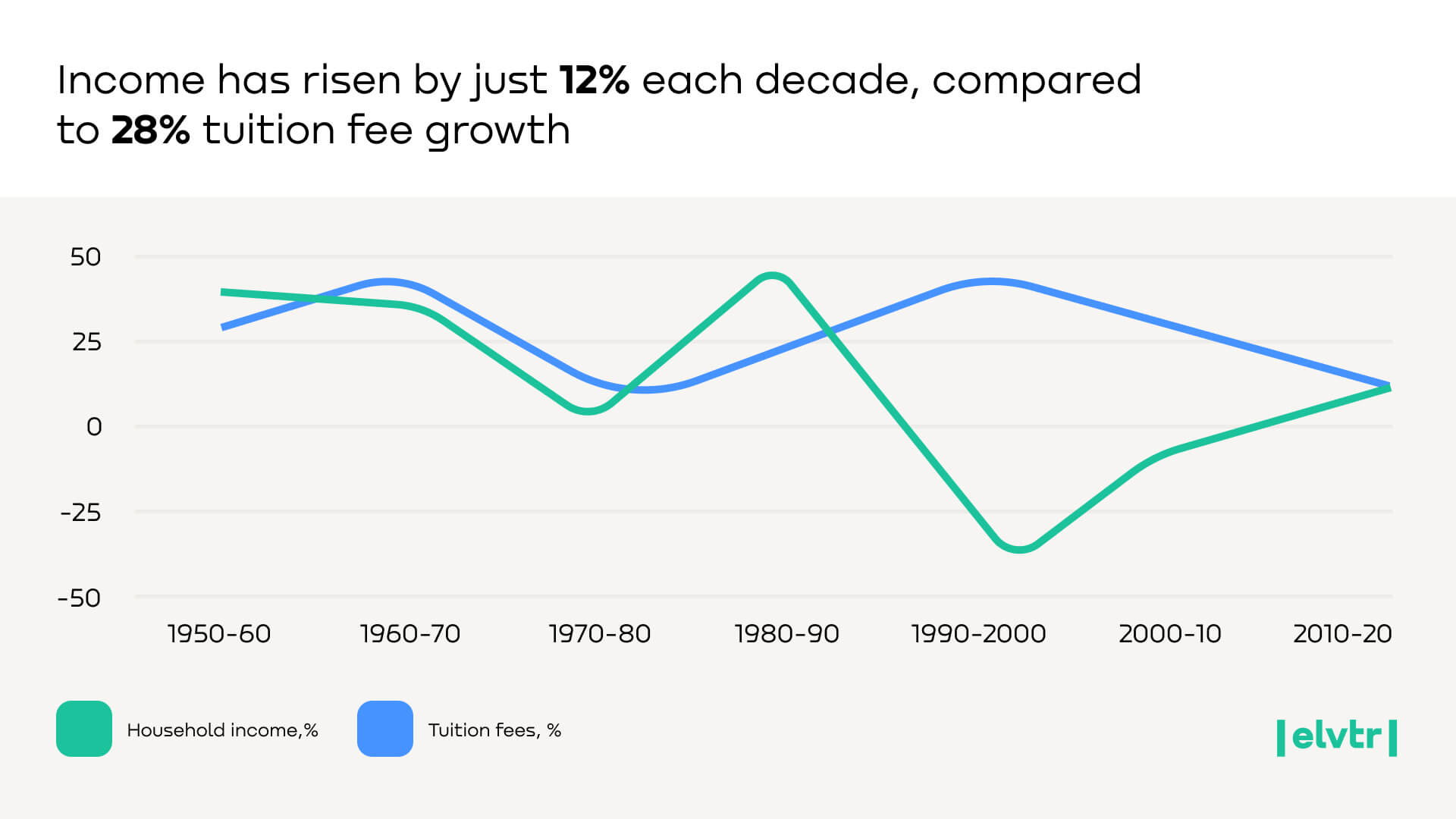

With every decade, tuition fees climb by another 28%. Yet, often the increase is far steeper – in the 1960s, prices rocketed by more than 40% across the US.

The rate of change has varied drastically from school to school too. The cost of attending Columbia University during the 1990s? $9,391. And just a decade later? $29,788.

Meanwhile, median household income lags behind, growing at an average of just 12% per decade.

The true cost of achieving your dream career (and don’t forget the interest)

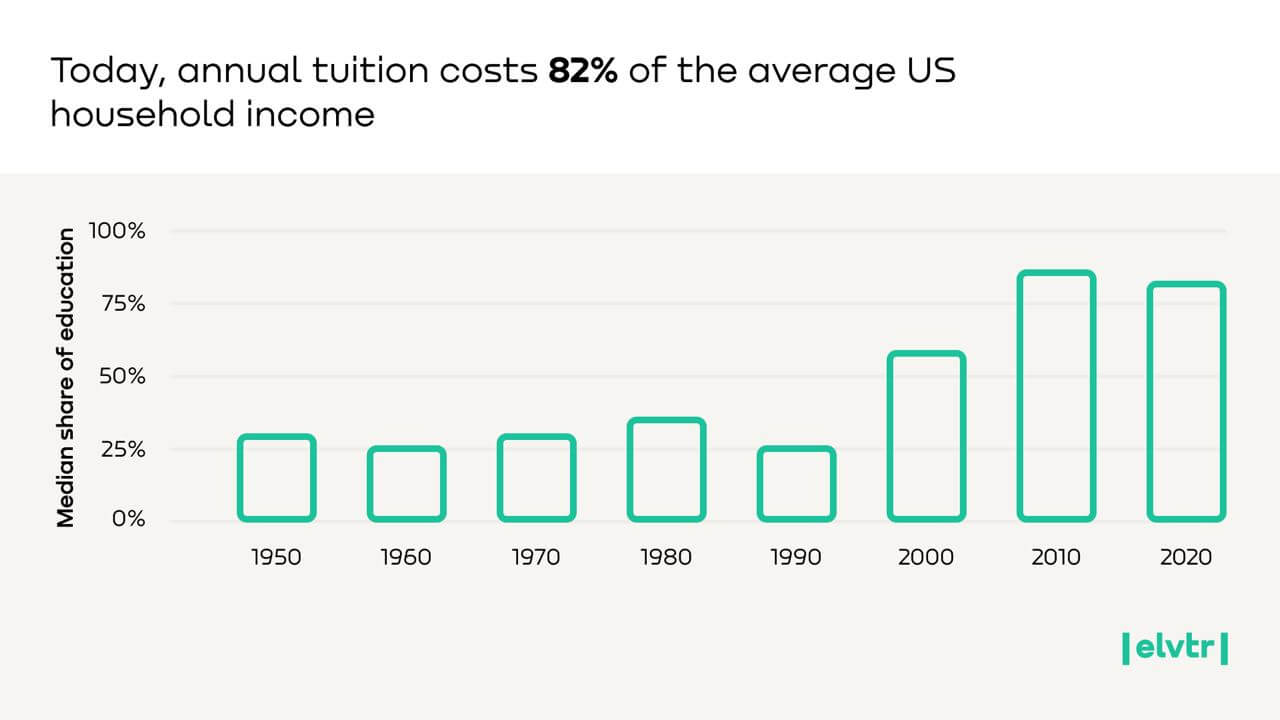

Until the late 80s, just 30% of the average household income was enough to secure an education from one of the United States’ top institutions. For somebody attending Harvard in the 50s, the total yearly cost was just 18% of average earnings. Similarly, a degree from Duke University in the 70s required just 20%. With some small spending cutbacks, it was entirely possible for students to pay for their studies upfront.

However, over the past 30 years these indicators have almost tripled. Today, students face paying out more than 80% of their annual household income. Given the high cost of living, students would starve long before they completed their degree if they attempted to pay upfront. Yet, the only alternative is debt for decades to come.

In some cases, annual fees even topped the average income. For instance, attending Columbia University in the 2010s cost $51,544, compared to average earnings of $49,445.

There has been a minor improvement since. Today, a year at Columbia only costs 91% of the average. Likewise, less expensive institutions such as Duke University or the University of Pennsylvania only cost around 70%.

Still far from affordable, the modern student faces a difficult choice: put their dreams on hold or take out an extortionate loan and spend years paying off the interest.

Recommended courses

Education ROI: Rising tuition costs provide graduates with decades of financial (in)stability

Today’s graduates are being short-changed by the education system as rising costs and falling rewards leave them far worse off.

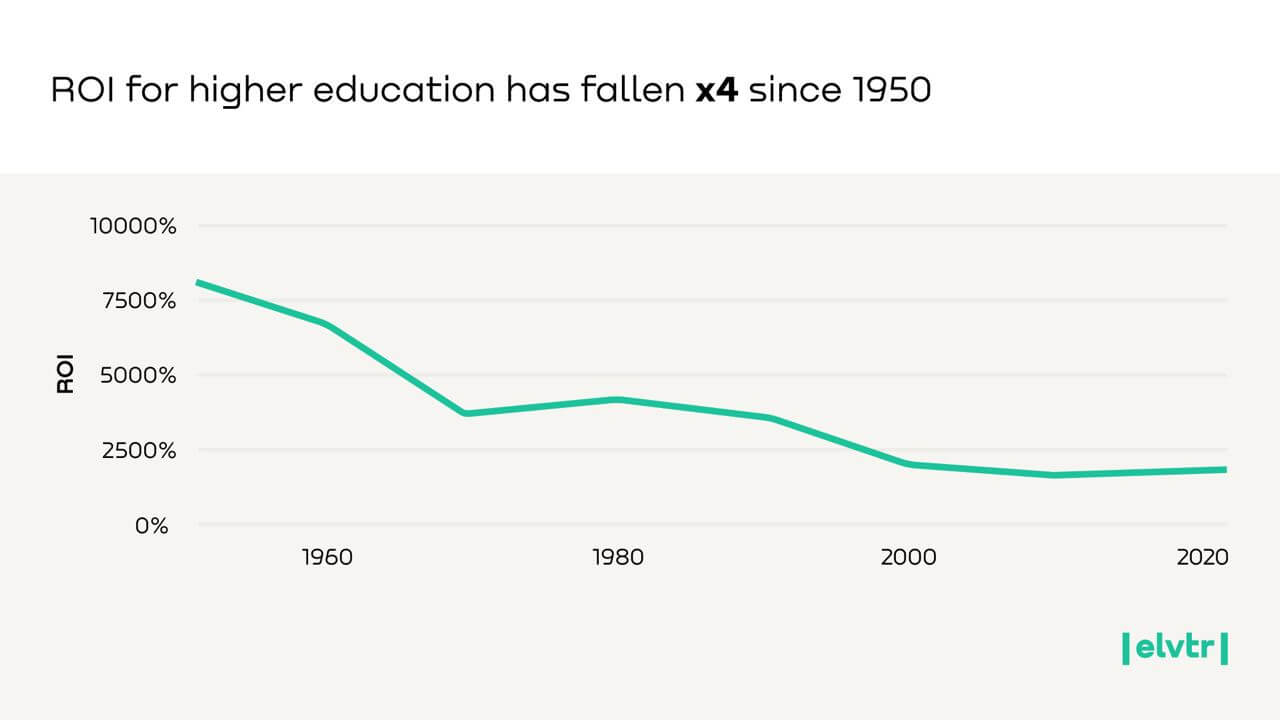

In 1950, four years of education at a respectable college cost $39,472 when adjusted for inflation. Making the average US income for the next five decades, their lifetime earnings would total $3,242,360. That’s a return of 8,114% – not too bad, right?

Except it has fallen fourfold since. Rather, today’s graduates can expect a return of just 1,829%. And with every decade, the reward for taking on this crippling debt shrinks by another 14%.

* ROI calculated as "income - cost of investment / cost of investment * 100"

College tuition inflation: Rising costs and slow wage growth are delaying repayment

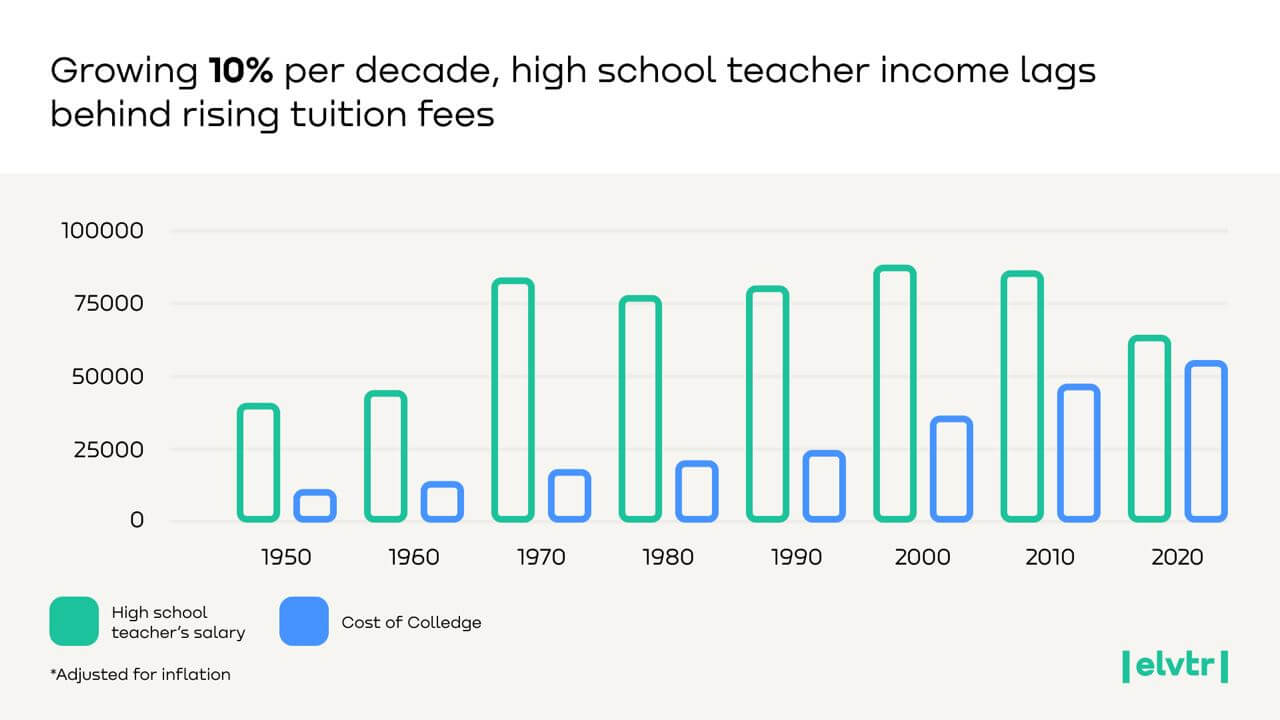

Paying a fortune, you would at least expect a rewarding salary that matches the sky-high cost of higher education. Yet, while tuition fees have increased 5.5 times over the past 70 years, high school teachers’ salaries have only risen 1.5 times in the same period.

In the past, a few months of graduate earnings could cover the investment. Now, it can take decades to get back to zero. That’s only considering tuition fees. Add on room and board, books and supplies, transportation and entertainment, all while interest continues to add to the amount due.

Of course, that depends on earnings. Yet, repayment times have increased across all key professions. In 1950, lawyers could cover the costs with just four months of work. Today, it requires two years. The same goes for high school teachers, who could pay back their fees in a year between 1950 and 1970. By 2010, they needed to work twice as long, while today 3.5 years of wages barely cover the costs. Even doctors, who still earn an average salary exceeding their training costs, require three times longer to pay back their fees than they did 20 years ago.

And let’s not forget, this all takes place in a fictional world where graduates can spend every cent they earn on clearing their debt.

The American dream nightmare: Dream careers shouldn’t cost decades of hardship

Back in the real world, a degree that was supposed to provide financial stability is actually a constant source of stress. Forced to take out a student loan, most will spend the next 10 to 30 years clawing together the money to pay it back.

And the issues in higher education are only getting worse. As the economic situation intensifies, many find themselves unable to make ends meet – today, more than 30% of student loan borrowers are in default, late, or have stopped making payments six years after graduation.

So, was it worth it, graduates?

Undoubtedly, some professions require lengthy training to ensure workers are up to the task. Nobody wants to go under the knife of a surgeon with an unsteady hand who faints at the first sight of blood. Yet, in many cases, the current issues in higher education far outweigh the benefits it provides. So why pay hundreds of thousands of dollars to attain a degree only to spend the best part of your working life scrimping and saving to pay it back?

*ELVTR is disrupting education by putting proven industry leaders in a virtual classroom with eager rising stars. ELVTR courses offer 100% instructor driven content designed to give you practical knowledge within a convenient time frame. Choose the right course for you!

Methodology and detailed findings

To create the study, researchers at ELVTR examined a range of publicly available data:

- Tuition fees over the last 70 years at 6 out of top-10 US colleges from the Best National University Ranking

- Median household income in the US over the last 70 years

- Average salaries of 3 timeless professions (lawyer, doctor, teacher) for the last 70 years

Sources: